Tax reforms in the United States have always been a central point of debate, affecting households, large corporations, and most importantly, small businesses. For small businesses, which are often referred to as the backbone of the American economy, tax changes can bring both opportunities and challenges. In 2025, as policymakers focus on balancing federal revenue with economic growth, a series of new tax reforms have been introduced that directly influence how small businesses operate, grow, and compete. Understanding these reforms is essential for entrepreneurs, startups, and family-run companies across the country.

This article explores the key aspects of the new tax reforms, their impact on small businesses, and strategies owners can adopt to navigate the evolving financial landscape.

The Importance of Small Businesses in the U.S. Economy

Small businesses are more than just companies; they are engines of innovation, local employment, and community growth. According to the U.S. Small Business Administration, small businesses account for nearly half of private sector employment in the country and make up 99.9% of all firms. Because of their scale, these businesses are more vulnerable to changes in tax laws than larger corporations with dedicated legal and financial teams. Any shift in policy, whether it involves deductions, credits, or compliance requirements, can ripple through their operations and long-term planning.

Key Features of the New Tax Reforms

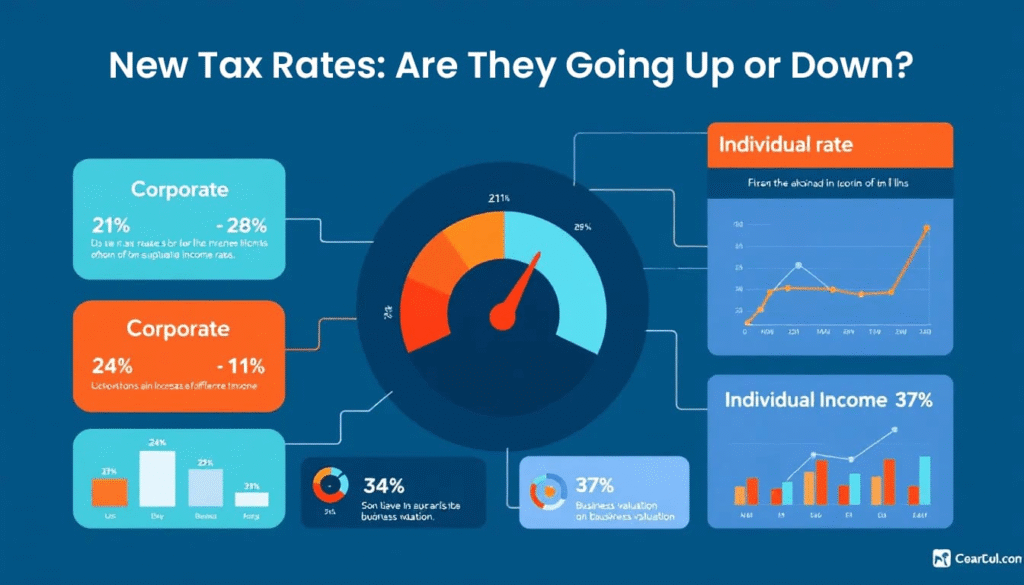

The latest round of U.S. tax reforms focuses on three main areas: lowering corporate tax burdens for smaller firms, simplifying compliance requirements, and adjusting deductions and credits to encourage reinvestment in business activities. Some of the notable changes include:

- Reduced corporate tax rates for small businesses: Businesses below a certain revenue threshold can now benefit from a slightly lower tax bracket, easing pressure on their profit margins.

- Increased Section 179 deduction limits: Small businesses can deduct more for equipment and machinery purchases upfront, giving them more flexibility in capital investment.

- Simplified tax filing for microbusinesses: Firms with very few employees and limited revenue have access to streamlined tax filing forms, reducing the administrative burden.

- Targeted tax credits for hiring and training: Incentives are now stronger for businesses that hire from underrepresented groups or invest in employee training programs.

- Stricter reporting for digital businesses: E-commerce, gig economy companies, and online service providers face new compliance requirements for reporting income and transactions.

Positive Outcomes for Small Businesses

For many small businesses, these reforms present meaningful advantages.

Increased Cash Flow

By lowering tax rates and raising deduction limits, small businesses have more cash on hand to reinvest in operations. This can mean hiring more staff, expanding to new markets, or upgrading technology without facing heavy financial strain.

Encouragement for Investment

The expanded Section 179 deduction allows businesses to purchase machinery, software, and office equipment and deduct the cost immediately, rather than depreciating it over several years. For manufacturers, contractors, and tech-driven startups, this is a huge incentive to modernize infrastructure.

Easier Compliance

The simplified filing process for microbusinesses reduces time spent on paperwork and decreases the likelihood of costly filing errors. For a business owner managing daily operations, this relief is significant.

Boost to Job Creation

With new tax credits tied to workforce expansion and employee training, small businesses gain financial rewards for creating jobs and improving employee skill sets. This not only supports business growth but also strengthens local economies.

Challenges and Concerns

While the new tax reforms bring relief in many areas, they also come with challenges that small businesses must address.

Complexity in Transition

Even though some reforms aim to simplify compliance, the transition period often introduces confusion. Business owners may struggle to interpret which rules apply to them, especially when dealing with state-level variations in tax codes.

Digital Compliance Burden

Online businesses and gig economy platforms now face stricter tax reporting standards. While this helps close tax loopholes, it increases the administrative load for digital entrepreneurs, many of whom already operate on thin margins.

Uncertainty of Future Changes

Tax policy in the United States is often tied to political cycles. What seems favorable today could be reversed or altered in a few years, making it difficult for small businesses to plan long-term financial strategies.

Limited Awareness and Resources

Large corporations have teams of tax experts to decode reforms. Small business owners, however, often lack the resources or time to fully understand how new rules affect them. Without proper guidance, they may miss out on deductions and credits intended to benefit them.

Sector-Specific Impact

Different industries will feel the effects of these reforms in unique ways.

- Retail and e-commerce: Stricter reporting requirements mean online sellers must ensure they track every transaction carefully. However, tax credits for job creation may help retailers hire seasonal staff.

- Manufacturing and construction: Increased deductions for equipment purchases are particularly beneficial, encouraging firms to invest in productivity-enhancing tools and machines.

- Professional services: Small law firms, consultancies, and agencies benefit from simplified filing procedures, freeing up more time for client-focused work.

- Technology startups: For young tech companies, the ability to deduct software and technology investments upfront provides a welcome financial cushion.

Strategies for Small Businesses to Adapt

To thrive under the new tax reforms, small business owners need a proactive approach.

- Work with a tax professional: Hiring a certified accountant or tax advisor ensures businesses take full advantage of deductions and credits while staying compliant.

- Adopt digital tools: Modern accounting software can simplify compliance, especially for e-commerce and service-based businesses dealing with digital reporting rules.

- Plan investments strategically: With increased deduction limits, businesses should align equipment and technology purchases with tax benefits to maximize savings.

- Stay informed: Tax laws evolve frequently, so staying updated through official IRS announcements, trade associations, and financial advisors is essential.

- Focus on workforce development: Taking advantage of hiring and training credits not only lowers tax liabilities but also strengthens a company’s long-term talent base.

Looking Ahead

The new tax reforms highlight the government’s recognition of small businesses as central to economic resilience and job creation. While not perfect, the reforms provide opportunities for growth, investment, and stability. However, challenges such as digital compliance, uncertainty of future changes, and limited access to expert guidance must be addressed for these benefits to reach their full potential.

Small businesses that adapt quickly, embrace technology, and seek professional advice are more likely to thrive in this evolving tax landscape. As America’s economic backbone, their success will continue to shape the broader economy, making it critical that reforms not only reduce burdens but also empower innovation, job creation, and sustainable growth.

Conclusion

New tax reforms in the United States present both opportunities and hurdles for small businesses. Lower corporate tax rates, expanded deductions, and hiring incentives will help businesses reinvest and expand, while stricter reporting rules and compliance challenges will test their adaptability. For entrepreneurs, the key lies in proactive planning, leveraging available benefits, and staying ahead of policy shifts. With the right approach, small businesses can turn these reforms into a catalyst for growth, strengthening their role as the foundation of the U.S. economy.