Risk control framework for startups, startup risk management 2025, risk mitigation strategies, business risk control plan, risk governance for entrepreneurs

Learn how to build a robust risk control framework for your startup in 2025. From risk identification to control implementation, this guide covers everything modern founders need to protect their business.

Introduction: Why Risk Control Is Non-Negotiable for Startups

Startups are inherently risky. Whether you’re building the next AI unicorn or launching a niche D2C brand, every founder must face one reality: without a risk control framework, you’re flying blind.

According to Startup Genome, 90% of startups fail, and one of the top 5 reasons is poor risk management. In 2025, with increased regulatory scrutiny, economic uncertainty, and rising cybersecurity threats, building a risk control framework is not just important — it’s essential.

The Business Case for Risk Control

- 85% of venture-backed startups cite “unexpected risks” as a major scaling challenge. (Harvard Business Review, 2024)

- Cybersecurity attacks have increased 38% YoY, especially targeting startups. (IBM Threat Index, 2025)

- Only 34% of U.S. startups in Seed to Series B have a formal risk governance process. (CB Insights, 2025)

Key Elements of a Startup Risk Control Framework

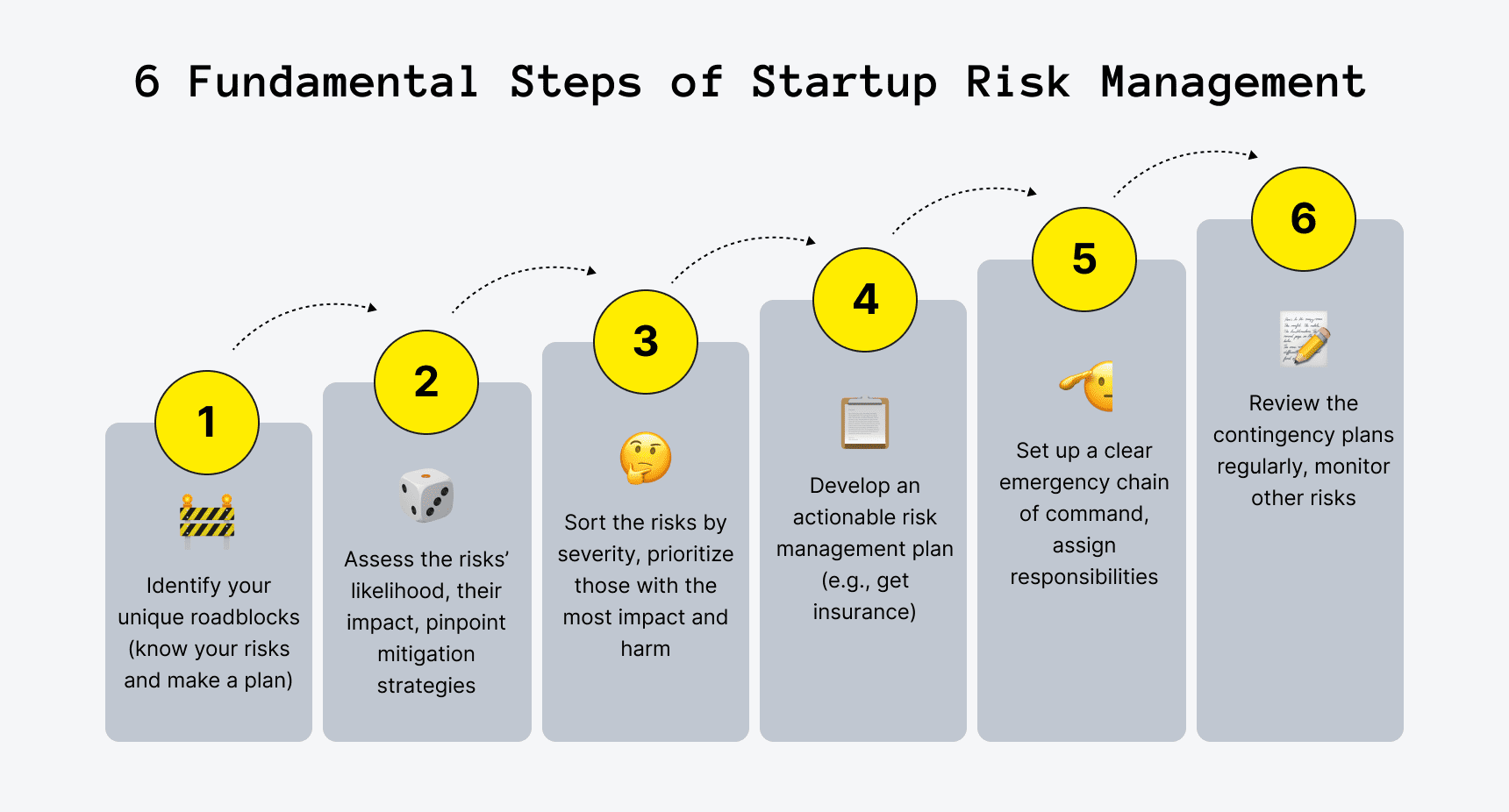

1. Risk Identification

Begin by listing all potential risks—internal and external. Categories include:

- Strategic (market misfit, scalability)

- Financial (cash burn, poor forecasting)

- Operational (supply chain issues, staff gaps)

- Legal/Compliance (IP, data privacy)

- Cybersecurity

2. Risk Assessment & Prioritization

Use frameworks like:

- Risk Matrix (Impact x Likelihood)

- SWOT-R (Risk extension of SWOT Analysis)

Quote:

“Startups often chase speed over safety. But smart risk is scalable risk.” — Ben Horowitz, Andreessen Horowitz

3. Control Design

Put systems and procedures in place to control the risk. Examples:

- Two-factor authentication for cyber risk

- Budget review cycles for financial risk

- Legal templates for contracts and NDAs

4. Implementation & Training

- Create a risk owner for each category

- Provide training for your team (monthly refreshers, onboarding sessions)

5. Monitoring & Reporting

- Use tools like JIRA, Notion, or Trello for risk logs

- Monthly risk reviews with leadership team

- Quarterly external audits (optional but recommended)

Pro Tip: Use the “3Rs” Risk Model for Startups

Recognize → React → Reinforce

This agile model ensures you build systems that adapt as your startup grows.

Real-World Example: How Brex Used Risk Control to Scale Fast

Brex, the fintech startup, implemented real-time transaction monitoring and KYC controls in its early stages. This proactive approach allowed them to scale into a billion-dollar business while staying compliant.

Key Takeaways

- Building a risk control framework early on increases investor trust and operational stability.

- A good risk strategy includes risk identification, assessment, control design, and monitoring.

- Use accessible tools like Notion, Airtable, or Google Sheets to start managing risk from day one.

- Risk control isn’t just about avoiding disaster—it’s about creating a foundation for scale.

FAQs

Q1. Why do startups need a risk control framework?

Startups face uncertainty in every direction—finance, operations, compliance. A framework helps you identify and mitigate these proactively.

Q2. What is the best tool for tracking risks?

For early-stage startups, tools like Airtable, Notion, or even Excel can be effective. As you grow, consider GRC platforms like LogicGate or VComply.

Q3. Should a startup hire a risk officer?

Not initially. But designate someone (like a cofounder or ops lead) as a risk owner until you scale.

Q4. How do investors view startups with a risk plan?

Positively! 71% of U.S. angel investors prefer startups that can demonstrate risk awareness and control systems.

#StartupRisk #FoundersFramework #WealthInStock