When most people hear about the Federal Reserve, or simply “the Fed,” they imagine something distant, complicated, and perhaps only relevant to Wall Street investors and economists. In reality, the decisions made by the Federal Reserve have a direct influence on the daily lives of Americans—particularly when it comes to borrowing money. Whether you’re applying for a mortgage, financing a car, paying off student loans, or even using credit cards, the Fed’s actions shape how much you pay in interest and how affordable borrowing is overall.

Understanding the Federal Reserve’s role is crucial for everyday borrowers. Let’s explore how this central bank affects borrowing, spending, and financial stability for millions of Americans.

The Federal Reserve’s Main Role

The Federal Reserve is the central bank of the United States. Its primary responsibilities are to:

- Control inflation and maintain stable prices

- Promote maximum employment

- Ensure a stable and secure financial system

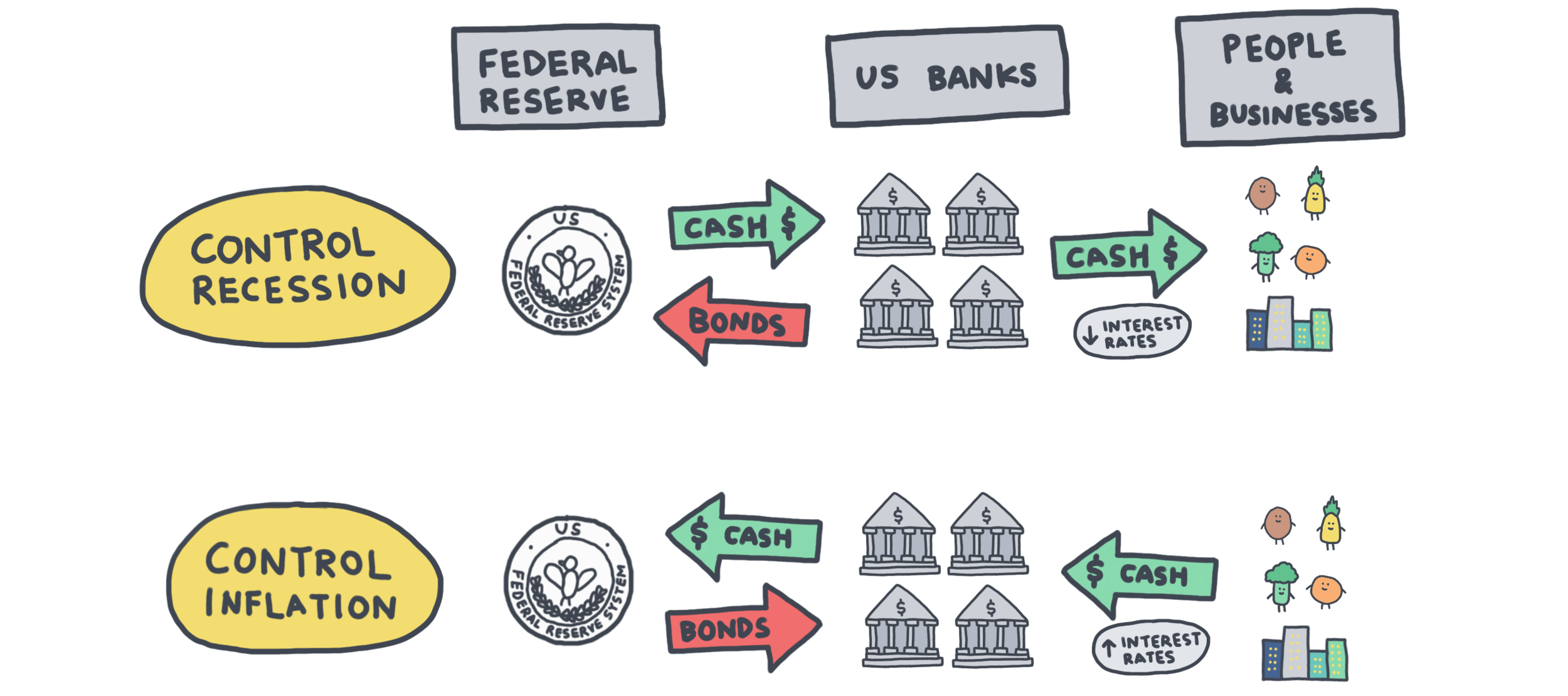

To achieve these goals, the Fed uses tools like adjusting interest rates, buying or selling government securities, and setting bank reserve requirements. These policies may sound abstract, but they ripple through the economy and land right in the pockets of ordinary borrowers.

Interest Rates and Borrowing Costs

The Fed’s most visible impact on everyday Americans comes from its control over interest rates. Specifically, the Fed sets the federal funds rate, which is the rate banks charge each other for overnight loans. This benchmark influences nearly all other borrowing rates in the economy.

When the Fed raises rates, borrowing becomes more expensive. Credit card interest goes up, mortgage rates climb, and auto loans cost more. Conversely, when the Fed lowers rates, borrowing becomes cheaper, encouraging consumers and businesses to spend and invest.

For instance, if you’re planning to buy a home with a mortgage, a single percentage point change in rates can mean hundreds of dollars more—or less—on your monthly payment. That’s why homebuyers watch Fed announcements so closely.

Mortgages: The Big Impact on Homeownership

Perhaps the clearest example of the Fed’s influence is the housing market. Mortgage rates don’t move exactly in step with the federal funds rate, but they are heavily influenced by it.

- When rates rise: Monthly mortgage payments increase, making homeownership more difficult for first-time buyers. Higher borrowing costs also cool down the housing market, often reducing demand and slowing price growth.

- When rates fall: Home loans become cheaper, encouraging more buyers to enter the market. Many existing homeowners also refinance their mortgages at lower rates, reducing their monthly obligations and freeing up money for other expenses.

So, if you’re an American considering buying a house or refinancing your mortgage, the Fed’s decisions are among the most important factors to track.

Credit Cards and Everyday Spending

Credit card debt is another area where the Fed’s policies directly touch consumers. Most credit cards in the U.S. have variable interest rates tied to the prime rate, which itself is influenced by the federal funds rate.

When the Fed hikes rates, credit card interest rates go up, making it more expensive to carry a balance from month to month. This can quickly become costly for households already dealing with high levels of debt. On the other hand, when the Fed lowers rates, interest charges decrease slightly, easing the burden for cardholders.

For everyday Americans who rely on credit cards for emergencies or large purchases, the Fed’s decisions can make a noticeable difference in their monthly bills.

Auto Loans and Student Loans

Beyond mortgages and credit cards, the cost of other common loans—like auto loans and student loans—is also linked to Fed policy.

- Auto loans: Car dealerships and lenders adjust their financing offers based on interest rate trends. Higher Fed rates usually translate into more expensive monthly payments for car buyers.

- Student loans: Federal student loan interest rates are set annually based on the 10-year Treasury note, which is influenced by Fed policy. Private student loans, however, are often variable and directly tied to market rates, meaning the Fed’s decisions can raise or lower payments for borrowers still in school or in repayment.

Indirect Effects: Jobs and Wages

The Fed doesn’t just influence borrowing costs; its policies also affect employment and income, which indirectly shape a borrower’s ability to repay loans.

- If the Fed raises rates aggressively, borrowing slows, businesses cut back on investments, and hiring may weaken. This can lead to slower wage growth or even job losses.

- If the Fed lowers rates, economic activity tends to pick up, businesses expand, and more jobs are created, giving borrowers greater confidence and income to manage debt.

For everyday borrowers, this connection between interest rates, job stability, and income security is just as important as the cost of loans.

Inflation and Borrowing Power

Another critical aspect of the Fed’s role is controlling inflation. Inflation reduces the purchasing power of money, meaning borrowers might face higher living costs even if their loan payments remain the same.

By raising rates, the Fed tries to cool down inflation, which helps stabilize prices for goods and services. While higher rates may make borrowing costlier, they protect consumers from runaway price increases that could make it harder to meet financial obligations.

The Ripple Effect on Personal Finance

The ripple effects of Fed decisions extend to multiple aspects of personal finance:

- Savings accounts: Higher interest rates mean better returns on savings accounts and certificates of deposit (CDs).

- Retirement planning: Bond yields rise when rates go up, potentially improving returns for more conservative investors.

- Stock investments: Higher rates can cool down the stock market, affecting investment portfolios tied to retirement savings or wealth-building plans.

For borrowers, these ripple effects create a balancing act. While loan payments may rise with Fed rate hikes, savings and investment returns could also improve.

How Borrowers Can Prepare

Since the Federal Reserve’s decisions are outside individual control, everyday borrowers need strategies to minimize risks:

- Lock in fixed-rate loans: Fixed-rate mortgages and personal loans protect you from sudden spikes in rates.

- Pay down variable-rate debt: Reduce credit card balances and other variable-rate loans when rates are rising.

- Build an emergency fund: Job stability can be affected by Fed policy, so having savings can cushion financial shocks.

- Stay informed: Monitoring Fed announcements helps you make smarter decisions about refinancing, new loans, or big purchases.

Conclusion

The Federal Reserve may seem like an abstract institution operating far from everyday life, but its influence on American borrowers is very real. From the mortgage rates that determine home affordability to the credit card balances people manage each month, the Fed’s policies shape financial decisions across households nationwide.

By raising or lowering interest rates, the Fed directly impacts how much it costs to borrow money, while also influencing jobs, wages, and inflation. Everyday Americans can’t control these decisions, but they can prepare for them by managing debt wisely, saving consistently, and paying attention to economic signals.