Tax incentives are one of the most influential tools the U.S. government uses to shape corporate behavior. These incentives are designed to encourage businesses to invest, innovate, and contribute to economic growth while aligning with policy goals such as job creation, environmental sustainability, and technological advancement. Understanding how these incentives function and how corporations respond to them offers insight into the dynamic relationship between public policy and private enterprise.

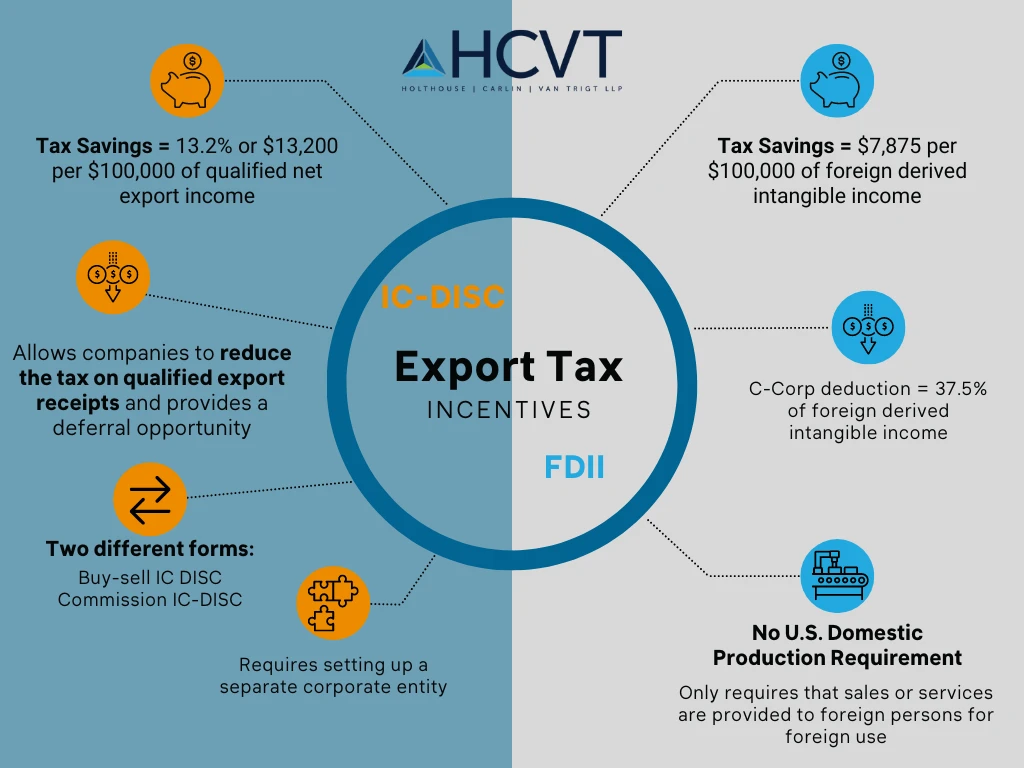

At their core, tax incentives reduce the amount of taxes a company owes, either through deductions, credits, or exemptions. This financial relief allows businesses to allocate resources in ways that might not otherwise be feasible. For instance, a company that receives a tax credit for research and development (R&D) can invest more in innovative projects, potentially leading to breakthroughs that enhance competitiveness and market share. Such incentives not only stimulate innovation but also strengthen the U.S. economy by fostering new industries and technologies.

Encouraging Investment and Expansion

One of the primary ways tax incentives influence corporate behavior is by encouraging investment and expansion. Companies often weigh the cost of new projects, including equipment purchases, facility expansions, and workforce growth, against the potential financial benefits. Tax incentives can tip this balance, making certain investments more attractive. For example, accelerated depreciation allowances allow businesses to write off the cost of new equipment more quickly, reducing their taxable income in the short term and improving cash flow. This benefit often leads companies to invest in modern machinery, technology upgrades, or energy-efficient solutions sooner than they might have otherwise.

Similarly, location-based tax incentives, such as those offered through Opportunity Zones or state-level programs, encourage businesses to invest in specific regions. By offering tax breaks for establishing operations in economically disadvantaged areas, the government promotes regional development, reduces unemployment, and stimulates local economies. Corporations often consider these incentives when deciding where to locate new facilities, demonstrating the direct impact of tax policy on corporate decision-making.

Influencing Employment Practices

Tax incentives also play a significant role in shaping employment practices. Programs like the Work Opportunity Tax Credit (WOTC) provide businesses with tax reductions for hiring individuals from targeted groups, including veterans, ex-offenders, and long-term unemployed workers. These incentives not only help companies reduce labor costs but also promote social objectives, such as workforce inclusion and economic mobility.

By incentivizing the hiring of specific groups, tax policy can lead companies to diversify their workforce and adopt more socially responsible employment practices. The result is a workforce that benefits from broader opportunities, while corporations enjoy cost savings and enhanced reputation. In this way, tax incentives serve as a powerful tool for guiding corporate behavior in socially beneficial directions.

Promoting Sustainability and Environmental Responsibility

In recent years, environmental sustainability has become a key focus of U.S. tax policy. Tax incentives for renewable energy, energy-efficient equipment, and environmentally friendly practices encourage companies to adopt greener operations. For instance, investment tax credits for solar energy installations or deductions for energy-efficient building improvements motivate businesses to reduce their carbon footprint and embrace sustainable practices.

Corporations respond to these incentives by integrating sustainability into their business models. Beyond tax savings, these actions can enhance brand reputation, attract environmentally conscious consumers, and prepare companies for regulatory changes. Tax incentives, therefore, not only influence financial decisions but also shape corporate strategies and values, encouraging businesses to prioritize long-term environmental stewardship.

Driving Research and Innovation

Research and development tax credits are among the most significant tools for stimulating innovation. The federal R&D tax credit allows companies to deduct a portion of their qualifying research expenditures, reducing their overall tax liability. This incentive has a profound impact on corporate behavior, as it makes investing in innovation more financially viable.

Companies often expand R&D activities to take full advantage of these credits. This investment leads to new products, improved processes, and technological breakthroughs that strengthen the company’s competitive position. Additionally, the R&D tax credit encourages small and medium-sized businesses to innovate, leveling the playing field against larger corporations with more resources. By linking financial incentives directly to innovation, tax policy drives continuous improvement and supports long-term economic growth.

Influencing Corporate Financing Decisions

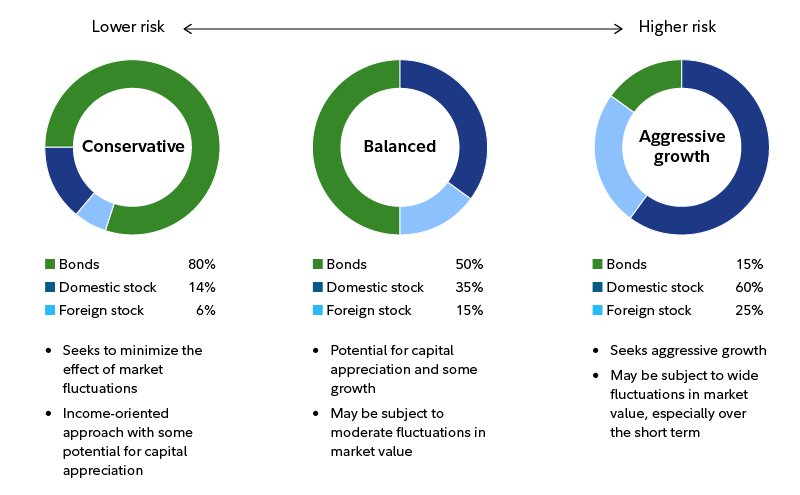

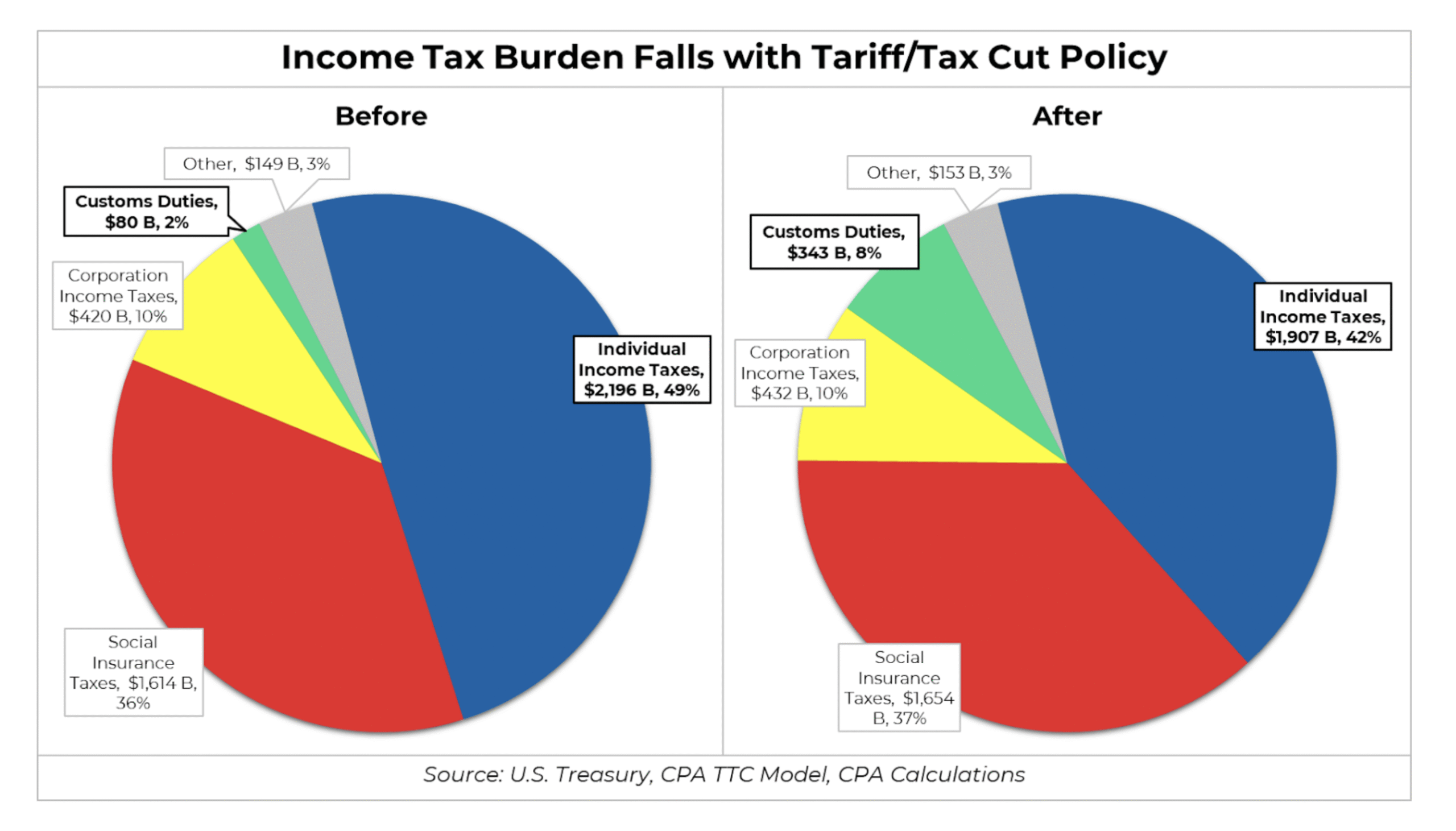

Tax incentives also shape corporate financing strategies. For example, certain deductions related to interest payments or capital investments influence how companies fund projects. Businesses may choose debt over equity financing or prioritize capital expenditures that maximize tax benefits. These decisions directly impact the company’s financial structure, risk management, and overall growth trajectory.

Moreover, tax incentives tied to stock options or employee ownership plans can encourage companies to adopt strategies that align employee and shareholder interests. By providing favorable tax treatment for stock-based compensation, corporations are incentivized to attract and retain top talent while motivating employees to contribute to the company’s long-term success.

Balancing Risks and Benefits

While tax incentives offer numerous advantages, they also require careful consideration. Corporations must weigh the benefits of tax savings against compliance requirements, potential scrutiny from tax authorities, and the broader strategic goals of the business. Misalignment between tax incentives and company strategy can lead to ineffective decision-making or missed opportunities.

Furthermore, policymakers continuously evaluate the effectiveness of tax incentives to ensure they achieve desired outcomes without excessive revenue loss. As a result, corporations must remain agile and adapt their behavior to changing incentives and regulatory landscapes. Those that strategically leverage tax incentives often gain a competitive edge, while others may struggle to optimize financial and operational performance.

Conclusion

In America, tax incentives are far more than financial tools—they are instruments that actively shape corporate behavior. From encouraging investment and expansion to promoting sustainability, innovation, and inclusive employment practices, these incentives guide companies toward decisions that align with broader economic and social objectives.

Businesses that understand and strategically respond to tax incentives can maximize financial benefits while contributing to national priorities. Conversely, policymakers rely on these incentives to influence corporate behavior, drive innovation, and stimulate economic growth. The interplay between tax policy and corporate strategy highlights the crucial role of incentives in shaping the U.S. business landscape. As tax laws evolve, corporations that adapt to these changes will continue to thrive, while contributing to a stronger, more dynamic economy.