Inflation has become one of the most pressing financial concerns for American households in recent years. Prices for groceries, fuel, housing, and everyday essentials continue to climb, reducing purchasing power and straining family budgets. For households aiming to build wealth in such an environment, the challenge may seem daunting. Yet history shows that periods of high inflation also present opportunities to grow and protect wealth when approached strategically.

This article explores practical ways U.S. households can build and preserve wealth during times of elevated inflation.

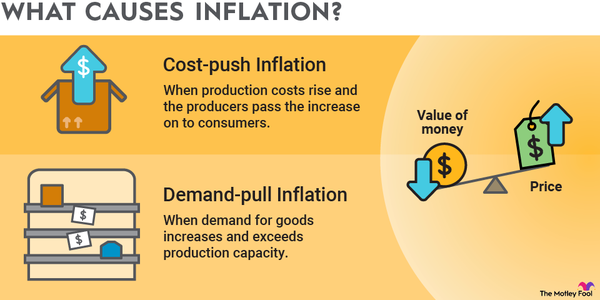

Understanding the Impact of Inflation on Wealth

Before diving into strategies, it’s important to understand how inflation erodes wealth. Inflation reduces the value of money over time. For example, if annual inflation is 6%, a dollar today will only have the purchasing power of about 94 cents next year.

This affects savings, investments, and income streams differently:

- Cash savings lose value quickly because they don’t keep pace with rising prices.

- Fixed income investments like bonds may underperform, as their returns can’t beat inflation.

- Hard assets such as real estate or commodities tend to hold or increase value during inflationary times.

Recognizing these dynamics allows households to make better financial decisions that protect their wealth.

Investing in Inflation-Resilient Assets

One of the most effective strategies for building wealth during inflation is to allocate funds toward assets that historically outperform in such environments.

- Stocks: Many U.S. companies have pricing power, allowing them to pass higher costs onto consumers. Sectors like technology, healthcare, and consumer staples often perform better.

- Real Estate: Property values and rental income typically rise with inflation, making real estate a strong hedge. Homeownership also protects households from rising rents.

- Treasury Inflation-Protected Securities (TIPS): These government bonds are indexed to inflation, ensuring that the principal and interest payments adjust with price levels.

- Commodities: Gold, oil, and agricultural products often see price increases when inflation is high, making them valuable hedges.

By diversifying into these inflation-resistant assets, households can protect their wealth from erosion.

Focusing on Income Growth

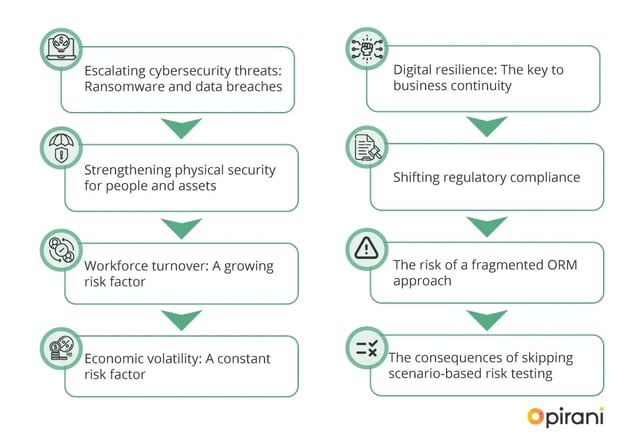

Building wealth during inflation is not only about investments—it’s also about increasing income. Since inflation diminishes purchasing power, households should focus on skills, careers, and side hustles that can adapt and thrive in changing economic conditions.

- Upskilling and Career Advancement: Acquiring in-demand skills such as data analysis, AI, cybersecurity, or healthcare expertise can lead to higher wages.

- Entrepreneurship: Starting a small business, freelancing, or offering services online provides new income streams that can grow faster than inflation.

- Negotiating Salaries: Workers should actively negotiate pay raises, especially in sectors experiencing labor shortages.

Households that grow their incomes at or above the inflation rate will maintain or even improve their financial position.

Smart Debt Management

Debt can either hurt or help during inflation. For households, the key is to differentiate between high-interest debt and inflation-friendly debt.

- Eliminate High-Interest Debt: Credit card balances and personal loans with high interest rates become more expensive as inflation rises. Paying these off quickly should be a priority.

- Leverage Fixed-Rate Loans: Mortgages and student loans with fixed interest rates actually become easier to pay back over time, as inflation reduces the real value of the debt.

For example, a household with a fixed 30-year mortgage benefits because the monthly payment remains constant, even as wages and rental prices increase.

Maintaining a Balanced Emergency Fund

Even though inflation reduces the value of cash, households should not eliminate their emergency savings. A good balance is to keep three to six months’ worth of essential expenses in a high-yield savings account or money market fund.

This provides financial security in case of job loss or medical emergencies while minimizing exposure to inflation’s effects. Importantly, choosing savings vehicles with higher interest rates—such as online banks—helps preserve more value.

Reducing Lifestyle Inflation

A hidden danger during inflationary times is “lifestyle inflation,” where households increase spending as wages rise. To build wealth, families must resist this urge and instead allocate additional income toward investments and savings.

For example:

- Instead of upgrading to a larger home immediately, families could invest in real estate funds.

- Rather than overspending on luxury goods, they could redirect money into retirement accounts or stock portfolios.

Conscious spending and budgeting ensure that wealth grows even when costs rise.

Taking Advantage of Tax-Efficient Accounts

Tax policies can significantly impact wealth-building efforts. Households can maximize their after-tax returns by using retirement and investment accounts that provide tax benefits.

- 401(k) and IRA Accounts: Contributions reduce taxable income today while allowing investments to grow tax-deferred.

- Roth IRA Accounts: While contributions are taxed upfront, withdrawals in retirement are tax-free—providing inflation-protected income.

- Health Savings Accounts (HSAs): These offer triple tax benefits: contributions are deductible, growth is tax-free, and withdrawals for medical expenses are untaxed.

Using these accounts strategically enables households to build wealth more efficiently despite inflation.

Investing in Education for the Next Generation

Building wealth isn’t just about the present—it’s also about securing the financial future of children and future generations. Education savings plans, such as 529 plans, allow parents to invest in their children’s education while receiving tax advantages.

This not only reduces the long-term financial burden of rising college costs but also contributes to generational wealth by giving children the skills needed to earn higher incomes.

Long-Term Mindset and Patience

Wealth-building during inflation requires a long-term perspective. Economic cycles change, and inflationary periods eventually stabilize. Families who stick to disciplined investment strategies, avoid panic selling, and focus on long-term goals are more likely to emerge stronger financially.

For instance, U.S. stock markets have historically outperformed inflation over decades, even if short-term volatility feels unsettling. Patience and consistency are critical to building lasting wealth.

Practical Steps Households Can Take Today

To summarize, here are actionable steps households can implement immediately:

- Review and adjust household budgets to prioritize savings and investments.

- Pay down high-interest debt while holding onto fixed-rate loans.

- Diversify investments into stocks, real estate, TIPS, and commodities.

- Negotiate higher wages or pursue new income streams.

- Use tax-advantaged accounts for retirement and health savings.

- Maintain an emergency fund while minimizing excess cash holdings.

- Practice conscious spending to reduce lifestyle inflation.

Conclusion

High inflation is challenging for U.S. households, but it doesn’t have to derail wealth-building efforts. By focusing on inflation-resistant investments, increasing income, managing debt wisely, and leveraging tax-efficient accounts, families can not only protect their financial well-being but also continue building long-term wealth.