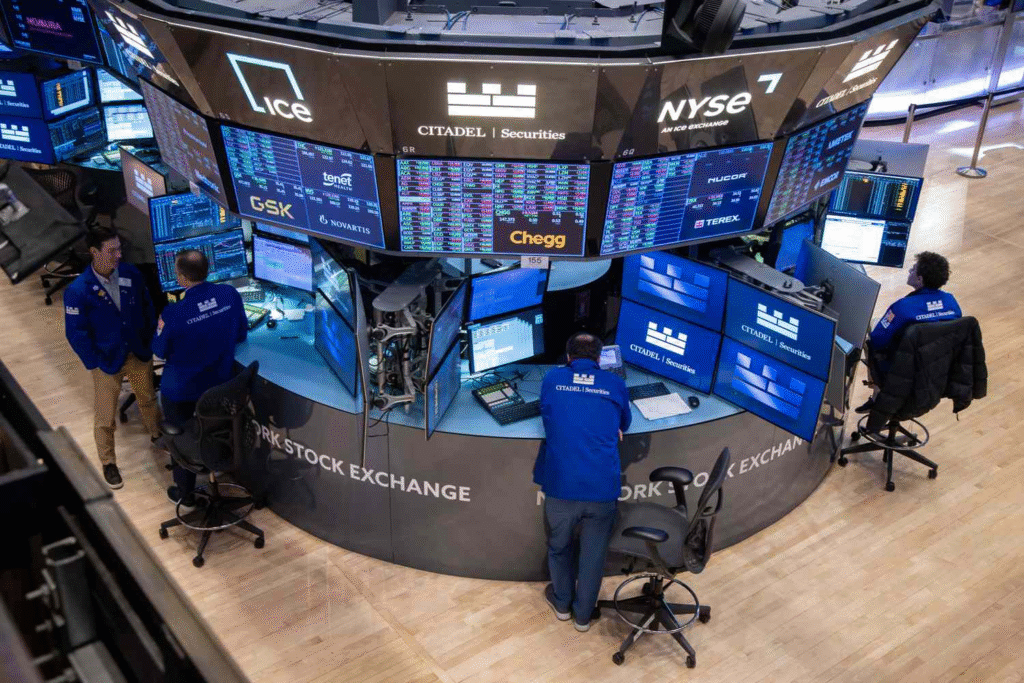

Wall Street’s story in 2025 is one of resilience, transformation, and sector-driven growth. Despite lingering global uncertainties, U.S. markets have demonstrated remarkable strength, fueled by specific industries that continue to set the pace for economic expansion and investor confidence. As the Federal Reserve carefully calibrates interest rates and inflationary pressures begin to stabilize, investors are focusing on which sectors are generating real momentum.

This year, several key sectors stand out as the driving forces behind Wall Street’s gains. Technology remains dominant, energy has found renewed strength, healthcare is proving its defensive appeal, and consumer discretionary sectors are benefiting from shifting spending patterns. Let’s take a closer look at which areas are powering the markets in 2025.

Technology: Still the Engine of Growth

Technology has been the undisputed leader on Wall Street for over a decade, and 2025 is no exception. The rise of artificial intelligence (AI) continues to redefine industries and create opportunities for exponential growth. Companies specializing in AI-driven software, cloud computing, and semiconductors are capturing the attention of both institutional and retail investors.

NVIDIA, AMD, and other chipmakers remain at the forefront, as demand for processors supporting AI, data centers, and autonomous vehicles skyrockets. Meanwhile, major players like Microsoft, Apple, and Alphabet are leveraging AI to improve efficiency, launch new consumer products, and strengthen their ecosystems.

Beyond AI, cybersecurity firms are seeing significant growth as data protection becomes a top priority for corporations and governments. With cyber threats increasing globally, the need for security solutions is pushing this subsector into the spotlight.

Investors have embraced the tech sector not only for its innovation but also for its resilience in uncertain economic conditions. Even as interest rates remain elevated, the sector’s robust earnings reports and future-forward outlook are driving stock prices higher.

Energy: A Blend of Old and New

The energy sector has reemerged as a strong performer in 2025, though its composition looks very different compared to past decades. Traditional oil and gas companies are benefiting from geopolitical disruptions and tight supply, which have kept prices elevated. U.S. energy giants such as ExxonMobil and Chevron are reporting strong earnings, bolstered by both domestic production and global demand.

At the same time, renewable energy companies are seeing unprecedented growth. The U.S. government’s incentives for green infrastructure, coupled with corporate commitments to reduce carbon emissions, are pushing solar, wind, and battery storage companies into profitable territory. Firms focused on hydrogen power and next-generation battery technologies are attracting heavy investment, signaling that the clean energy transition is no longer just a policy vision but an investable reality.

This dual strength—traditional fossil fuels alongside renewables—makes the energy sector one of the most dynamic contributors to Wall Street’s gains in 2025. Investors see it as a hedge against inflation, while also positioning themselves for long-term sustainability growth.

Healthcare: A Defensive Powerhouse

Healthcare remains a cornerstone of the U.S. economy, and in 2025, it is proving to be a reliable driver of Wall Street performance. Rising demand for medical services, an aging population, and continued innovation in biotech are keeping healthcare stocks strong.

Pharmaceutical companies are pushing forward with groundbreaking treatments in oncology, rare diseases, and personalized medicine. Biotech firms, many of which faced volatility in recent years, are now stabilizing as new therapies secure FDA approvals and attract global partnerships.

Another major theme in healthcare this year is telemedicine and digital health. After experiencing rapid adoption during the pandemic, these services have matured and are now integrated into mainstream healthcare systems. Companies enabling remote patient monitoring and AI-assisted diagnostics are reporting robust growth.

For investors, healthcare offers both defensive stability during economic slowdowns and significant upside potential through medical innovation. It is no surprise that healthcare ETFs and major stocks in this sector are enjoying strong inflows in 2025.

Consumer Discretionary: Spending Returns with a Twist

Despite inflationary challenges, American consumers are showing surprising resilience in 2025. Consumer discretionary stocks—those tied to non-essential goods and services—are gaining momentum as spending habits shift toward experiences, luxury, and lifestyle upgrades.

Travel and leisure companies are experiencing a post-pandemic boom. Airlines, hotel chains, and cruise operators are reporting record bookings, driven by pent-up demand and a desire for new experiences. At the same time, luxury brands are thriving as affluent consumers continue to spend on high-end fashion, automobiles, and accessories.

E-commerce is another bright spot within this sector. While traditional retail continues to struggle, online shopping platforms and digital-first brands are thriving, particularly those leveraging AI for personalization and supply chain optimization. Companies like Amazon and Tesla remain bellwethers, but emerging firms in electric vehicles and direct-to-consumer retail are also gaining traction.

Consumer discretionary stocks are proving that even in times of economic uncertainty, Americans continue to prioritize lifestyle and convenience, making this sector a surprising but powerful market mover in 2025.

Financials: Benefiting from Higher Rates

The financial sector is also contributing to Wall Street’s strength this year. Banks and financial institutions are seeing improved profit margins as elevated interest rates boost lending income. While the Federal Reserve’s rate hikes have slowed down, current levels remain favorable for banks’ bottom lines.

Additionally, investment firms and asset managers are experiencing gains as market optimism drives capital inflows. The growing popularity of ETFs, retirement funds, and alternative investments is providing steady revenue streams for major players in this space.

Fintech remains a fast-growing subsector, as digital payment platforms and blockchain-driven innovations continue to disrupt traditional banking models. Companies offering solutions in digital wallets, peer-to-peer lending, and decentralized finance (DeFi) are attracting younger investors and reshaping the financial landscape.

Industrials and Infrastructure: Riding the Investment Wave

Another sector powering Wall Street in 2025 is industrials, particularly companies tied to infrastructure. Government spending on rebuilding roads, bridges, and public transit systems is creating a strong demand for construction firms, equipment manufacturers, and engineering companies.

Defense contractors are also benefiting from heightened geopolitical tensions, with increased defense budgets driving strong order pipelines. Meanwhile, logistics and shipping companies are enjoying steady demand as global trade stabilizes post-pandemic.

Industrials may not always be flashy, but they are playing a critical role in ensuring consistent market growth this year.

The Big Picture

Wall Street’s 2025 performance is not being carried by a single sector but rather by a combination of technology, energy, healthcare, consumer discretionary, financials, and industrials. This diversification is healthy for the markets, as it spreads risk across industries and creates multiple avenues for investors to capture growth.

The overarching themes driving these gains include the rise of AI, the transition to renewable energy, medical innovation, consumer resilience, financial adaptation, and infrastructure investment. Together, these forces are creating a robust and forward-looking market landscape.

Final Thoughts

For investors, understanding which sectors are driving Wall Street gains in 2025 is crucial for making informed decisions. Technology continues to be the headline leader, but ignoring the contributions of energy, healthcare, consumer discretionary, financials, and industrials would mean missing out on major opportunities.