Building wealth in the United States often comes down to more than just earning a salary—it requires strategic saving and investing. Among the most powerful tools available to American workers are 401(k) plans and Individual Retirement Accounts (IRAs). These retirement-focused accounts are designed not just to help individuals prepare for life after work but also to serve as key vehicles for long-term wealth accumulation.

When used effectively, they provide tax advantages, compound growth opportunities, and a disciplined savings structure that can significantly increase financial security. Let’s explore the roles of 401(k)s and IRAs in wealth building, their advantages, limitations, and strategies for maximizing their benefits.

Understanding the Basics

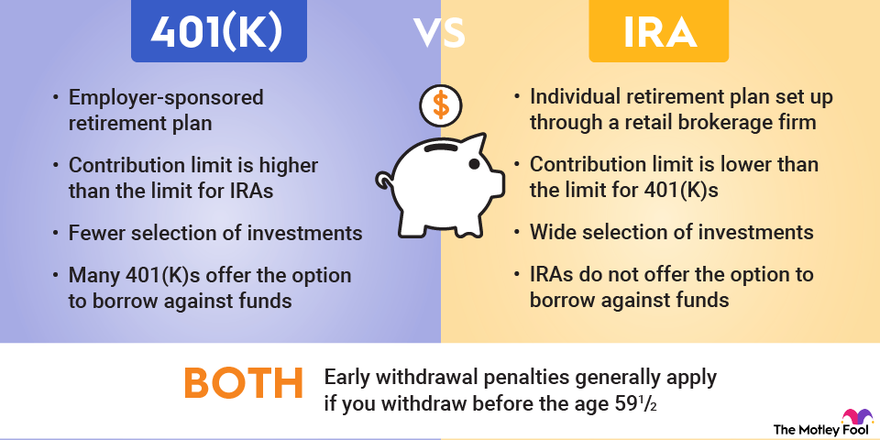

A 401(k) is an employer-sponsored retirement plan that allows workers to save a portion of their income, often with an employer match. Contributions can be made on a pre-tax basis (traditional 401(k)) or post-tax (Roth 401(k)), depending on the plan options available.

An IRA (Individual Retirement Account) is a retirement savings account that individuals open independently, outside of their workplace. Like the 401(k), IRAs come in two primary forms: traditional (pre-tax contributions) and Roth (after-tax contributions).

Both accounts share the same goal: encouraging Americans to save and invest for retirement by providing tax incentives and access to a broad range of investment options.

Tax Advantages as a Wealth Builder

One of the biggest reasons these accounts play such a central role in wealth accumulation is their tax treatment.

- Traditional 401(k) and Traditional IRA: Contributions reduce taxable income in the year they are made, allowing savers to defer taxes until withdrawal in retirement. This provides immediate tax savings and allows the entire contribution to grow tax-deferred.

- Roth 401(k) and Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are completely tax-free if certain conditions are met. This means all growth, including decades of compounding interest and investment returns, can be withdrawn without additional taxes.

This dual system gives savers flexibility. For example, a worker in a high tax bracket today might favor traditional contributions for tax deductions, while a younger worker expecting to be in a higher bracket later might prefer Roth contributions to lock in tax-free withdrawals.

The Power of Compounding

The real engine of wealth accumulation in 401(k)s and IRAs is compound growth. By reinvesting investment earnings year after year, savers allow their money to snowball over time.

Consider this simple example:

- A 25-year-old invests $6,000 annually in a Roth IRA.

- Assuming a 7% average annual return, by age 65 the account could grow to nearly $1.3 million.

This shows that even moderate contributions, if started early, can lead to significant wealth. The tax-sheltered nature of these accounts enhances compounding by ensuring that gains are not eroded each year by taxes on dividends or capital gains.

Employer Matching: Free Wealth Growth

For 401(k) participants, employer matching contributions represent one of the most powerful forms of wealth building. Many U.S. companies offer a match—commonly 50 cents for every dollar up to a certain percentage of salary, or even a dollar-for-dollar match.

This match is essentially free money, and failing to contribute enough to receive the full match means leaving wealth on the table. Over a career, these employer contributions can add tens or even hundreds of thousands of dollars to a retirement portfolio.

Investment Options and Flexibility

Another wealth-building advantage lies in the investment choices within these accounts. Both 401(k)s and IRAs allow savers to allocate funds into stocks, bonds, mutual funds, ETFs, and other assets.

- 401(k)s often have a curated list of funds, including target-date funds designed for hands-off investors.

- IRAs provide broader flexibility, with nearly unlimited investment options.

By diversifying and choosing investments wisely, savers can tailor risk and return to their financial goals and time horizons, allowing for more personalized wealth accumulation strategies.

Building Discipline Through Structure

One of the overlooked roles of 401(k)s and IRAs in wealth building is the discipline they instill. Because contributions are often automatic (deducted from paychecks in the case of 401(k)s) and penalties discourage early withdrawals, these accounts encourage consistent saving.

This “forced savings” mechanism ensures that wealth accumulation continues in the background, even when individuals might be tempted to spend elsewhere. Over decades, this disciplined approach is often the difference between struggling in retirement and achieving financial freedom.

Wealth Building Beyond Retirement

While their primary purpose is retirement, 401(k)s and IRAs also play a broader role in wealth accumulation by:

- Reducing taxable income during peak earning years (traditional contributions).

- Creating tax-free wealth for heirs in certain Roth accounts.

- Shielding investments from annual taxation, allowing for faster growth compared to taxable accounts.

This makes them not just retirement tools, but strategic wealth vehicles that can support broader financial goals, including generational wealth transfer.

Limitations to Consider

Despite their advantages, these accounts do have limitations:

- Contribution Limits: In 2025, the annual contribution limit is $23,000 for 401(k)s (with an extra $7,500 for those over 50) and $7,000 for IRAs ($8,000 for those over 50). While substantial, these caps mean high earners may need additional investment vehicles.

- Withdrawal Rules: Withdrawals before age 59½ typically incur penalties, restricting access to funds. Exceptions exist, but they are limited.

- Required Minimum Distributions (RMDs): Traditional accounts require withdrawals starting at age 73, which can reduce tax efficiency in retirement.

Even with these restrictions, their wealth-building potential remains unmatched for most savers.

Strategies to Maximize Wealth with 401(k)s and IRAs

To harness the full power of these accounts, consider the following strategies:

- Always contribute enough to a 401(k) to capture the full employer match.

- Use a mix of traditional and Roth accounts to balance current and future tax exposure.

- Start contributions as early as possible to maximize compounding.

- Rebalance investments regularly to maintain risk tolerance.

- Consider backdoor Roth strategies for high earners who exceed income limits.

These approaches ensure that savers not only build retirement security but also maximize overall wealth accumulation potential.

Conclusion

In the landscape of personal finance, 401(k)s and IRAs are cornerstones of wealth accumulation in the United States. Their combination of tax advantages, compound growth, employer matching, and disciplined saving mechanisms make them indispensable tools for building long-term financial security.