Building wealth in America has always been tied to smart financial planning, discipline, and making informed choices. For young Americans today, the wealth-building journey looks different than it did for previous generations. Rising living costs, student loan burdens, inflationary pressures, and a changing job market create challenges—but they also present opportunities. With access to technology, side hustles, global investments, and financial education at their fingertips, young people have more tools than ever to create sustainable wealth.

This article explores the most effective wealth-building strategies tailored for young Americans who want to secure their financial future.

Start with a Strong Financial Foundation

Wealth-building begins with financial literacy and strong money habits. Before thinking about investments or business ventures, young Americans should focus on the basics: budgeting, saving, and managing debt.

A budget helps track income and expenses, making it easier to avoid overspending. Apps like Mint, YNAB (You Need a Budget), and personal banking tools simplify this process. By consistently tracking spending, young adults can spot unnecessary costs and redirect money toward wealth-building opportunities.

Another key aspect is creating an emergency fund. Having three to six months of living expenses in a savings account ensures that unexpected setbacks—such as medical bills or job loss—don’t derail long-term financial goals. Without this cushion, individuals risk falling into debt, which slows wealth growth.

Pay Off High-Interest Debt Early

One of the most common barriers to wealth for young Americans is debt, particularly from student loans and credit cards. While some debt, like a mortgage, can be considered “good debt” if it builds equity, high-interest debt eats away at income.

A smart strategy is the avalanche method, where the focus is on paying off debts with the highest interest rates first, while making minimum payments on others. Alternatively, the snowball method prioritizes paying off the smallest debts first to build momentum and motivation.

Eliminating debt early frees up cash that can then be redirected into savings, investments, or entrepreneurial ventures, significantly accelerating wealth-building.

Maximize Retirement Accounts Early

Time is the most powerful tool young Americans have when it comes to building wealth. By starting early, even small investments grow exponentially through compound interest.

Employer-sponsored retirement accounts like 401(k)s often come with matching contributions. Not taking advantage of this is essentially leaving free money on the table. For those without employer-sponsored plans, opening an IRA (Individual Retirement Account) or Roth IRA is an excellent alternative.

The Roth IRA, in particular, is popular among young investors because contributions are made with after-tax income, allowing tax-free withdrawals in retirement. This provides long-term benefits, especially for individuals who are likely in lower tax brackets today compared to their future earning years.

Invest in the Stock Market

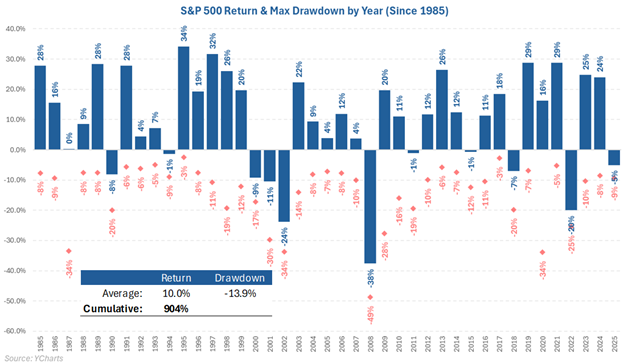

Beyond retirement accounts, young Americans should consider investing in the stock market. While risky in the short term, historically, the U.S. stock market has delivered consistent long-term growth.

Exchange-Traded Funds (ETFs) and index funds are great starting points. They provide diversification and lower risk compared to individual stocks, making them ideal for beginner investors. Popular funds like those tracking the S&P 500 allow young investors to own a small piece of America’s largest companies.

For those comfortable with higher risk, exploring individual stocks, dividend-paying companies, or even growth sectors like technology and renewable energy can be rewarding. The key is consistency—investing a set amount monthly through dollar-cost averaging helps mitigate the impact of market volatility.

Build Multiple Income Streams

Relying on a single income source is risky in today’s economy. Young Americans are increasingly turning to side hustles and entrepreneurial ventures to build wealth.

Freelancing, content creation, e-commerce, and consulting are just a few ways to generate additional income. Platforms like Upwork, Etsy, and Shopify make it easier than ever to start small businesses or monetize skills.

Additionally, passive income strategies such as rental property investment, dividend stocks, or peer-to-peer lending can create streams of income that grow independently of active work. The more diverse the income portfolio, the greater the resilience against financial downturns.

Invest in Real Estate

Real estate remains a cornerstone of wealth-building in America. While rising property prices can make ownership seem daunting, there are multiple entry points.

Young buyers can start small by purchasing rental properties in affordable markets or even “house hacking”—living in one unit of a multi-family property while renting out the others. This strategy allows them to build equity while tenants cover mortgage payments.

Real Estate Investment Trusts (REITs) provide another accessible route, allowing individuals to invest in real estate without owning physical property. These can be purchased like stocks and often provide steady dividends.

Prioritize Continuous Learning and Skill Development

One of the most overlooked wealth-building strategies is investing in oneself. Skills directly translate into earning potential. In a rapidly evolving economy, adaptability is essential.

Young Americans should focus on acquiring high-demand skills such as data analysis, coding, digital marketing, financial management, or renewable energy expertise. Continuous education—whether through formal degrees, certifications, or online courses—enhances career growth and income potential.

Higher income not only increases savings and investments but also provides flexibility in lifestyle and future opportunities.

Practice Smart Spending and Lifestyle Choices

Wealth isn’t only about earning more—it’s also about keeping more of what you earn. Many young Americans fall into the trap of lifestyle inflation, where expenses rise as income grows.

Adopting minimalist spending habits, avoiding unnecessary luxury purchases, and prioritizing experiences over material goods can help preserve capital. A focus on living below one’s means accelerates wealth-building and creates financial independence sooner.

Build a Strong Credit Score

A healthy credit score opens doors to wealth-building opportunities. It affects loan approvals, mortgage rates, insurance premiums, and even job applications in some industries.

Young Americans should pay bills on time, keep credit utilization low, and avoid excessive debt to maintain strong credit. A high credit score ensures lower borrowing costs, saving money over time that can be redirected into investments.

Network and Seek Mentorship

Lastly, wealth-building isn’t just about money management—it’s also about connections. Surrounding oneself with financially literate individuals and mentors provides insights, strategies, and opportunities that can accelerate success.

Mentorship can help young Americans avoid common mistakes, learn investment strategies, and explore entrepreneurial ventures. Professional networks also open doors to higher-paying jobs, partnerships, and collaborations.

Conclusion

The best wealth-building strategies for young Americans combine discipline, smart financial decisions, and continuous learning. By mastering the basics of budgeting, paying off debt, investing early, and creating multiple income streams, young adults can secure long-term financial independence.