The U.S. housing market is one of the most sensitive sectors to the Federal Reserve’s monetary policy. Every move by the Fed, whether it’s raising interest rates, cutting them, or adjusting its balance sheet, can ripple through mortgages, home sales, construction, and even rental demand. For millions of Americans, the Fed’s decisions determine how affordable it is to buy a home, refinance a mortgage, or invest in real estate. Understanding this connection is crucial for homeowners, prospective buyers, investors, and policymakers alike.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. Its primary goals are to promote maximum employment, stabilize prices, and ensure moderate long-term interest rates. To achieve these, the Fed uses tools such as:

- Federal Funds Rate – the short-term interest rate at which banks lend to each other.

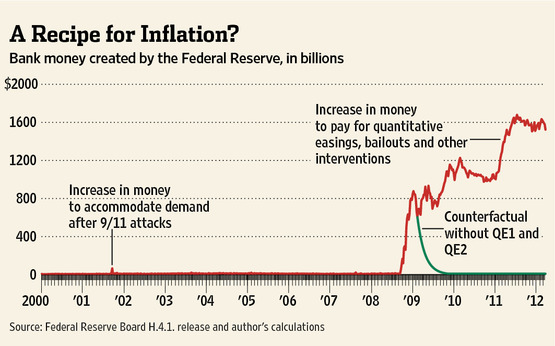

- Open Market Operations – buying or selling government securities to influence liquidity.

- Balance Sheet Adjustments – holding or reducing assets such as mortgage-backed securities (MBS).

Each of these tools indirectly impacts the housing market, mainly through changes in borrowing costs and credit availability.

Interest Rates and Mortgage Costs

The most direct way the Fed influences housing is through interest rates. When the Fed raises the federal funds rate, it increases borrowing costs for banks, which in turn pass those costs on to consumers. Mortgage rates, while not set directly by the Fed, tend to rise as a result.

For example, when mortgage rates climb from 3% to 6%, the monthly payment on a $400,000 loan can increase by more than $700. This change in affordability often pushes potential buyers out of the market, reducing demand and slowing home price growth.

Conversely, when the Fed lowers interest rates, mortgage rates typically follow. Lower rates make borrowing cheaper, encouraging more people to purchase homes, refinance existing mortgages, or invest in real estate. This often stimulates the housing market and can push home prices higher.

Housing Demand and Buyer Behavior

The Fed’s monetary policy strongly influences buyer psychology. Low interest rates make housing more affordable, boosting demand. During the COVID-19 pandemic, the Fed slashed rates to near zero and began purchasing billions of dollars in mortgage-backed securities. This led to historically low mortgage rates, sparking a housing boom. Bidding wars, record-high prices, and rapid appreciation became common.

On the other hand, when the Fed raises rates aggressively, as it did in 2022–2023 to fight inflation, demand cools dramatically. Buyers face higher borrowing costs, fewer qualify for loans, and many delay home purchases. This creates downward pressure on home sales and can even cause prices to stabilize or decline.

Impact on Homebuilders and Construction

Homebuilders are also directly affected by monetary policy. Higher interest rates increase the cost of financing construction projects. Additionally, when mortgage rates rise, demand for new homes weakens, leaving builders with excess inventory. This often leads to fewer housing starts and slower construction activity.

In contrast, when rates are low and demand is strong, builders ramp up construction, leading to job creation in related industries such as materials, appliances, and real estate services. Thus, Fed policy can accelerate or slow not just home sales, but the entire housing supply chain.

Rental Market Dynamics

Fed policy also affects the rental market indirectly. When high mortgage rates make buying a home less affordable, many households remain renters longer, driving up rental demand. This can cause rents to rise, particularly in major U.S. cities where supply is limited.

On the flip side, when borrowing costs are low and homeownership is more attainable, some renters move into the housing market, relieving pressure on rentals. Landlords, investors, and developers watch Fed policy closely to anticipate shifts in tenant demand.

The Wealth Effect and Consumer Spending

Housing is a major source of household wealth in the U.S. When Fed policy boosts the housing market, homeowners see the value of their properties rise. This creates a “wealth effect,” where people feel richer and spend more on goods and services, fueling broader economic growth.

However, if rising rates cause home prices to stagnate or decline, households may feel less wealthy and cut back on spending. This illustrates how closely housing and the overall economy are tied to monetary policy.

Mortgage Refinancing and Household Budgets

Another important connection is mortgage refinancing. When interest rates drop, millions of homeowners refinance their mortgages at lower rates, reducing monthly payments and freeing up disposable income. This extra spending capacity often flows back into the economy.

But when rates rise sharply, refinancing activity dries up. Homeowners lose the opportunity to lower payments, and household budgets may become tighter. This, in turn, reduces consumer spending and can slow economic growth.

Regional Impacts Across the U.S.

The Fed’s monetary policy does not affect all housing markets equally. High-cost regions such as California, New York, and Washington, D.C., feel the impact of rising rates more acutely because home prices are significantly higher. Even a small increase in mortgage rates can price buyers out of million-dollar homes.

In contrast, more affordable housing markets in the Midwest or South may be less sensitive to rate changes, as home prices and mortgages are smaller. Still, even in these regions, borrowing costs can determine whether families choose to buy, rent, or delay entering the market.

Long-Term Housing Affordability Challenges

While the Fed plays a critical role in short-term housing cycles, it cannot solve deeper structural issues in the U.S. housing market. Chronic underbuilding, restrictive zoning laws, and lack of affordable housing stock continue to strain buyers regardless of interest rates. Even when the Fed lowers rates, the benefits may be offset by limited supply, keeping prices high.

This means monetary policy is a powerful but imperfect tool for influencing housing affordability. Policymakers at the federal, state, and local levels must also address supply-side challenges to ensure more sustainable housing markets.

Looking Ahead: Fed Policy and Housing in 2025

As of 2025, the Federal Reserve continues to balance the fight against inflation with the risk of slowing the economy too much. Housing sits at the center of this balancing act. If rates remain high, affordability will stay challenging, keeping pressure on buyers and slowing sales. If the Fed begins cutting rates, the housing market could see renewed activity, but this might reignite price growth in markets already facing affordability crises.

For buyers, sellers, and investors, watching the Fed’s moves is essential. Mortgage rates are likely to remain volatile as the Fed adjusts its policies in response to inflation, employment, and global economic conditions.

Conclusion

The Federal Reserve’s monetary policy wields enormous influence over the U.S. housing market. By adjusting interest rates, managing liquidity, and influencing mortgage costs, the Fed shapes affordability, demand, construction, and even rental markets. While its policies can stimulate or cool housing activity, they are not a cure-all for the structural challenges America faces in housing supply and affordability.